Introduction

AI agents are autonomous software entities designed to perform tasks and make deicisons on behalf of humans or other systems. They range from relatively simple programs, such as chatbots that provide customer service, to highly complex systems capable of negotiating contracts, managing supply chains, or optimizing logistics networks. These agents have proliferated across industries as advancements in machine learning, cloud computing, and distributed systems have made them indispensable tools for automating processes and imrpoving efficiency.

Despite their advanced capabilities, AI agents must frequently engage in transactions involving real-world value. These transactions might include purchasing computational resources, subscribing to data streams, or compensating human contractors. To operate effectively, AI agents require a frictionless, reliable medium of exchange to facilitate these operations seamlessly and efficiently. Traditional payment systems often fall short in meeting these needs, and volatile cryptocurrencies can introduce significant financial risk. This is where stablecoins have emerged as an ideal solution.

Stablecoins are digital currencies pegged to stable assets, such a fiat currencies or commodities. They offer price stability, global accessibility, and programmability, making them uniquely suited for the transactional requirements of AI agents.

What are AI Agents and Why do They Transact Value?

AI agents are software-driven entities that operate with varying degrees of autonomy to achieve specific objectives. Unlike traditional sofware, which follows predefined instructions, AI agents are often designed to learn, adapt, and make decisions based on their environment and the data they encounter. Examples of AI agents include virtual assistants, autonomous trading bots, and supply chain manageent tools.

AI agents need to transact value for several reasons:

Resource Acquisition: AI agents require resources such as computational power, data streams, and cloud storage to perform their tasks. These resources are often purchased on a pay-as-you-go basis.

Compensating Humans: Many AI-driven workflows include human-in-the-loop tasks, such as quality assurance, creating input, or providing specialized expertise, which require monetary compensation.

Service Integration: AI agents often interact with other systems or services, forming ad hoc networks of collaboration where payments ensure smooth coordination.

Supply Chain Automation: In industries like logistics, AI agents coordinate with multiple entities, including warehouses, transport providers, and retailers. Payments ensure timely delivery and collaboration among stakeholders.

For example, an AI agent managing logistics might need to pay for live traffic data, compensate drivers for timely deliveries, and purchase analytics software to optimize routes. Each of these transactions involves real-world value and must be conducted in a seamless and reliable manner.

Why Stablecoins Over Traditional Payment Methods?

Traditional payment systems, such as bank transfers or credit card networks, are ill-suited for AI agents’ transactional needs. These systems are constrained by jurisdictional boundaries, high fees, and slow settlement times. For instance, cross-border payments can take days to process and incure significant costs, particularly for small, frequent transactions.

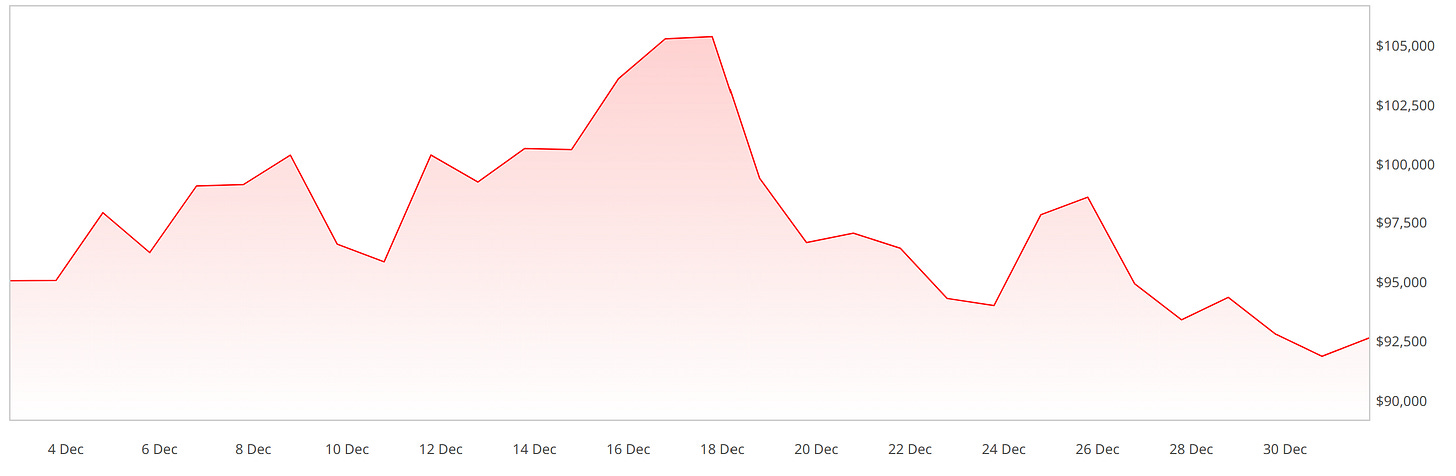

Cryptocurrencies like Bitcoin and Ethereum offer an alternative, but their volatility poses substantial risks. These assets fluctuate dramatically, making them unreliable for routine transactions or long-term budgeting. For instance, Bitcoin’s price can vary by thousands of dollars within a single year, introducing uncertainty into financial planing for AI agents.

Stablecoins address these limitations by providing:

Price Stability: Stablecoins are pegged to stable assets, such as the US dollar or a basket of fiat currencies, ensuring predictable value.

Global Accessibility: Stablecoins exist on blockchains, enabling fast, low-cost transactions that are not restricted by national borders or traditional banking hours.

Programmability: Stablecoins integrate seamlessly with smart contracts, allowing for automated, conditional payments that are executed without human intervention.

Transparency and Security: Stablecoin transactions are recorded on immutable blockchain ledgers, ensuring auditability and reducing the risk of fraud.

Reduced Counterparty Risk: Stablecoins’ decentralized nature minimizes reliance on intermediaries, reducing the likelihood of disputes or failed transactions.

Stablecoins such as USDC, DAI, and EuroC have become particularly popular due to their widespread adoption and regulatory compliance. They offer the stability of traditional fiat currencies combined with the efficiency of blockchain technology.

Advantages of Stablecoins for AI Agents

Aside from the advantages that stablecoins provide over traditional payment rails and volatile cryptocurrencies, they also offer advantages which are particularly relevant to AI agents:

Efficiency: Instant settlement reduces delays and improves cash flow management.

Cost-Effectiveness: Low transaction fees make stablecoins ideal for frequent, small payments.

Automation: Smart contracts enable autonomous transactions, reducing administrative overhead.

Scalability: Global accessibility allows AI agents to operate seamlessly across borders.

Predictability: Price stability eliminates the risk of financial disruption caused by volatile cryptocurrencies.

Interoperability: Many stablecoins are designed to work across various blockahin networks, increasing their utility for diverse AI systems.

These features make stablecoins the preferred medium of exchange for AI agents, ensuring that their transactional workflows remain efficient, reliable, and scalable.

Expanding the Role of Stablecoins in AI Ecosystems

The integration of stablecoins with AI systems is not limited to individual transactions. Entire ecosystems can emerge where AI agents, stablecoins, and blockchain technology converge:

Decentralized Marketplaces: AI agents can participate in decentralized platforms to buy and sell services such as data analytics, content generation, or predictive modeling. Payments in stablecoins ensure quick, seamless exchanges.

Collaborative AI Networks: Multiple AI agents can collaborate on complex tasks, such as conducting large-scale simulations or creating real-time translations. Stablecoins facilitate payments among agents without requiring human oversight.

Tokenized Incentives: Stablecoins can be used to incentivize contributions form human or AI participants in collaborative projects, ensuring fair distribution of rewards.

Global AI Intgeration: AI agents operating in different regions can transaction without the limitations of currency conversion or banking restrictions, leveraging the global reach of stablecoins.

Real-Time Microtransactions: For AI systems requiring frequent, small payments, such as IoT networks or ad-based platforms—stablecoins provide an ideal solution due to their low fees and instant settlements.

A Conjectural Example: Aurora, the AI Agent

Imagine Aurora, an AI agent designed to aggregate and analyze satellite imagery for commercial real estate developers. Aurora’s objective is to provide clients with actionable insights, such as identifying new construction activity or assessing environmental risks. To achieve this, Aurora must interact with a variety of data providers, human experts, and clients.

Aurora identifies a micro-satellite network offering high-resolution imagery updated hourly. The network charges for access to this data in increments of five minutes. Aurora negotiates a contract with the provider and agrees to pay using USDC, ensuring stable and predictable pricing.

Aurora executes the smart contract with the satellite provider, automatically transferring USDC upon receiving the requested imagery. This process is instantaneous, eliminating the delays associated with traditional payment systems.

To verify anomalies in the satellite imagery, Aurora hires specialized human analysts. Each completed task triggers an automated payment in DAI through a proof-of-work smart contract. This ensures analysts are compensated fairly and promptly.

Aurora processes the imagery and generates insights, such as identifying potential developmetn sites or flagging environmental concerns. These insights are sold to clients worldiwde, who pay in their preferred stableccoins, such as EuroC for European clients or USDC for North American clients.

Aurora maintains a treasury of stablecoins for operational expenses. Periodically, it converts a portion of these reserves to fiat curency to comply with local tax and regulatory requirements. This hybrid approach allows Aurora to balance efficiency with compliance.

Beyond its core tasks, Auroa collaborates with other AI agents in related fields. For example, it partners with an AI system that monitors environmental conditions, sharing resources and insights. Payments between these agents are streamlined using stablecoins, ensuring trust and efficiency in their collaboration.

Challenges and Considerations

While stablecoins offer significant advantages, their adoption by AI agents is not without challenges:

Regulatory Uncertainty: Varying regulations across jurisdictions complicate stablecoin use, particularly for cross-border transactions.

Technological Integration: Ensuring seamless integration between stablecoins and AI systems requires robust infrastructure and developer expertise.

Scalability of Blockchain Networks: As transaction volumes grow, some blockchains may become congested, leading to delays and higher fees1.

Dependence on Stablecoin Issuers: Centralized stablecoins, such as USDC, rely on the trustworthiness of their issuers2. Any failure or misconduct could impact their value and reliability.

Energy Consumption: Blockchain networks, particularly those which rely on proof-of-work mechanisms, can be energy-intensive3.

Conclusion

AI agents represent the next frontier in automation and digital collaboration, and their ability to transact value autonomously is critical to their success. Stablecoins provide the perfect solution to the challenges posed by traditional payment systems and volatile cryptocurrencies. With their stability, global reach, and programmability, stablecoins enable AI agents to operate seamlessly in a complex, interconnected economy.

As AI agents continue to evolve and proliferate, stablecoins will play an increasingly large role in facilitating their operations. Together, these technologies are poisted to reshape the way value is exchanged, paving the way for a more efficient and automated future.

There are various solutions here, which are beyond the scope of this post, among them being rollups (optimistic rollups and ZK rollups), state channels, etc.

Centralization is, of course, anathema to many in the cryptocurrency industry. Nonetheless, centralized solutions frequently offer pragmatic solutions for users who just want a system that works for their purposes. There is an inherent tension, yet to be resolved, between the ideals of decentralization and the practicalities of using technology that works for a given purpose.

Obviously, AI is also energy-intensive: we need vast new sources of power generation.