OpenSea Breakdown: The Growth Opportunities for a Two-Sided Marketplace for Digital Culture

Buy the rumor, sell the news

A quick note: this is a long (~3,000 words) post. I’ve broken it into three sections. The first section is an introduction to NFTs and OpenSea. Feel free to skip it if you’re already familiar. The second section explains OpenSea’s business model. The third section explores growth opportunities for OpenSea, given its two-sided marketplace model.

Note also that due to this post’s length, it will likely be truncated by Gmail. I recommend that you read this post on substack.com, not via email.

Introduction: The Digital Exchange of Culture

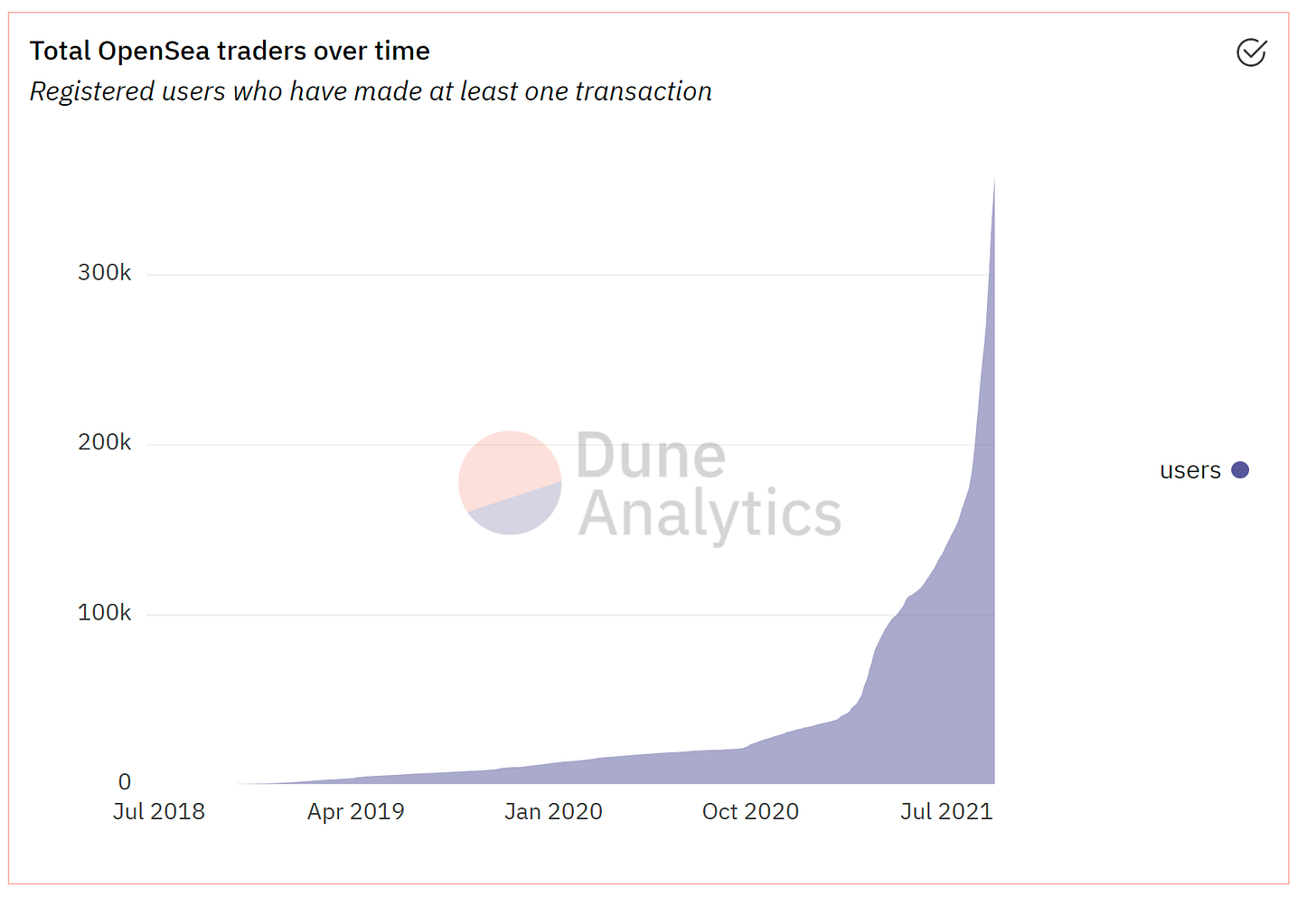

OpenSea is the largest NFT marketplace, accounting for something like 90% of the market as of August, 2021. According to another article from August, OpenSea facilitated 1.18 million transactions worth $1.06 billion in one month. Clearly, the company has been growing rapidly. It’s a useful exercise, then, to examine its business model, understand its growth opportunities, and figure out where it heads from here.

Another way of conveying OpenSea’s rapid growth is this J-curve:

Source: https://dune.xyz/queries/2877/5680 . Found via Twitter.1

Whatever OpenSea is doing, they’re certainly doing it right!

At a basic level, NFTs facilitate the digital exchange of culture. A few weeks ago, I tweeted:

This is worth unpacking a bit, because it allows us to understand how profound OpenSea is. I wrote a bit about the tweet here. Quoting myself:

Arnault runs LVMH, the world’s pre-eminent luxury goods retailer. He caters to luxurious desire. Desire is mimetic: if your friend desires clothing from a particular brand, you likely will too (even if you claim you’re resistant to marketing). If all of your friends shop at Whole Foods, you likely do, too.

How does this all relate to OpenSea? OpenSea is the marketplace where this digital exchange of culture happens! The first NFT I see for sale when I load OpenSea’s web site is this gorgeous set of four images:

Graphics are obviously much different from LVMH’s handbags. But, are they really? The Kardashians are known for collecting handbags. Elton John collects photographs. Now, the Kardashians and John obviously have vastly more money than most people, but both collect culture. They collect human creativity. OpenSea democratizes access to human culture by mediating the sale of NFTs.

NFTs have become so popular that even NPR has reported on them.

If this all sounds very theoretical or abstract, OpenSea’s CEO, Devin Finzer, has provided a very accessible introduction to NFTs, here. In his words:

Just as we had digital currencies (think airline points, in-game currencies) before cryptocurrencies emerged, we’ve had non-fungible digital assets since the dawn of the internet. Domain names, event tickets, in-game items, even handles on social networks like Twitter or Facebook, are all non-fungible digital assets; they just vary in their tradeability, liquidity, and interoperability. And many of them are incredibly valuable: Epic Games made $2.4 billion in revenue selling costumes in their free-to-play game Fortnite in 2018 alone, the market for even tickets is projected to reach $68 billion in 2025, and the market for domain names continues to see solid growth.

…

So it’s clear we already have tons of digital stuff. But to what extent do we “own” these digital things? If digital ownership only means that an item belongs to you and not someone else, then you own them in some sense. But if digital ownership in the physical world (the freedom to hold and transfer indefinitely), this doesn’t always seem to be the case with digital assets. Rather, you own these assets in specific contexts, which may or may not make moving them around easy. Try to sell a Fortnite skin on eBay, and you’ll discover the difficulty of moving digital assets from one person to another.

This is where blockchains come in! Blockchains provide a coordination layer for digital assets, giving users ownership and management permission. Blockchains add several unique properties to non-fungible assets that change the user and developer relationships with these assets.

OpenSea allows its users to use Ethereum, Polygon, or Klaytn. Polygon is a sidechain to Ethereum.

A quick note about fees: OpenSea generates revenue by assessing a 2.5% fee on each NFT sale. These fees are in addition to any gas fees assessed by the Ethereum network.

Sounds interesting, right? Let’s dive in to OpenSea’s business model, and then look the company’s growth opportunities and fees.

Breaking Down OpenSea’s Business Model

OpenSea operates a two-sided marketplace, in which it is an intermediary between supply and demand. In this sense, it is very much like Airbnb, eBay, or any other number of marketplaces.

Source: https://segment.com/blog/how-segment-models-growth-for-two-sided-marketplaces/

Supply: This is the set of NFTs available for sale on OpenSea’s marketplace at any given time. Some of these sales are primary, and some are secondary. Primary sales are sales conducted by the creator of the NFT. Secondary sales are done by those who have bought NFTs from their creator or other secondary sellers.

Demand: This is the set of buyers interested in buying NFTs on OpenSea’s marketplace at any given time.

It’s important to note that supply and demand can come from the same person. Someone can sell an NFT on OpenSea (supply) and, at the same time, buy a different NFT from another person (demand).

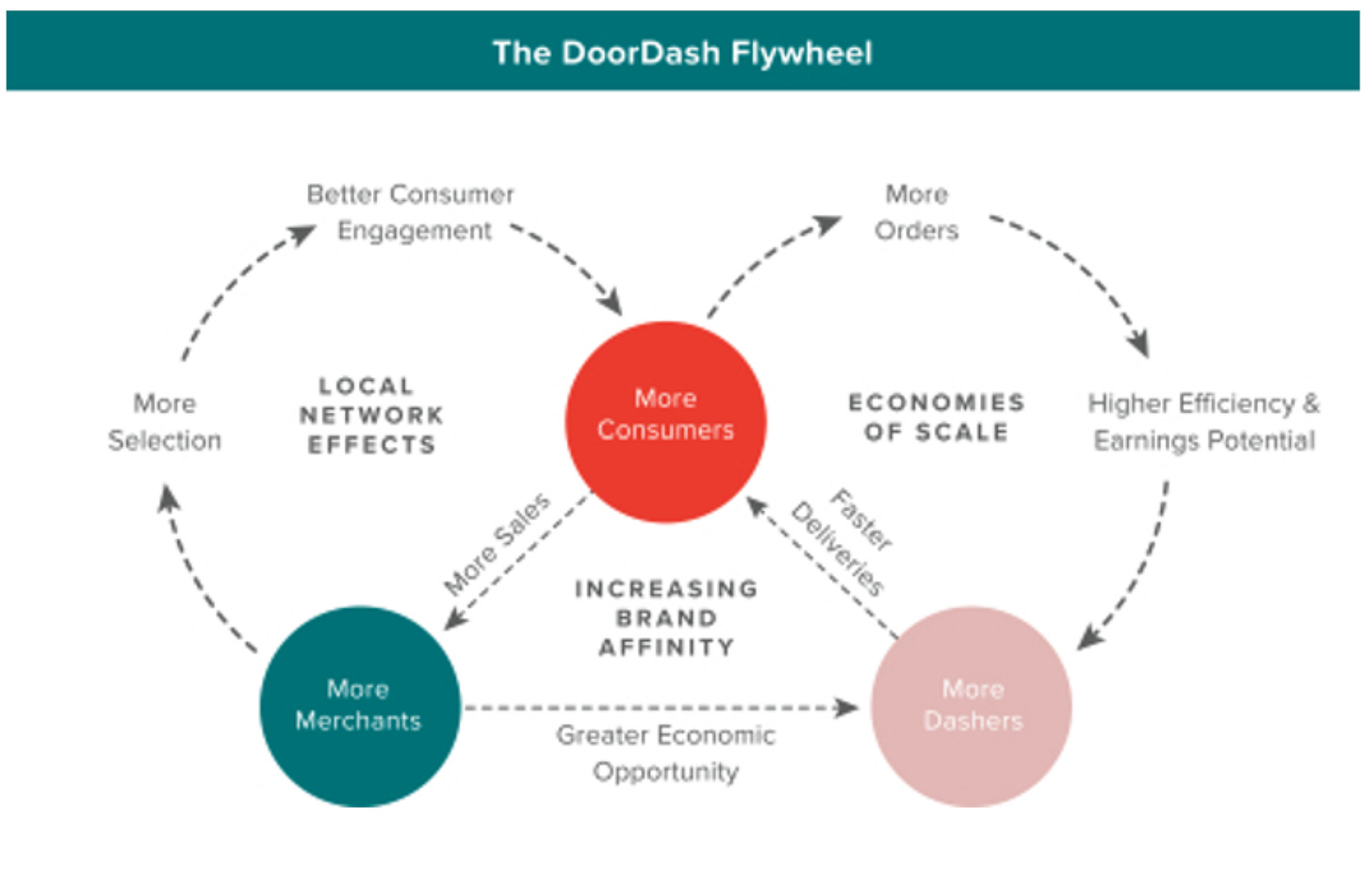

Two-sided marketplaces are very often winner-take-all markets, and the value of these marketplaces increases in rough proportion to the increase in supply and demand. As more suppliers sell on a marketplace and more buyers buy on the marketplace, the marketplace becomes more valuable.

This graphic of DoorDash’s flywheel explains the dynamic well:

Source: https://theflywheel.substack.com/p/doordash-flywheel-teardown

Just think about Amazon: when it first started, it only sold books, and there is a limited supply and demand for books. But as it expanded to sell more types of goods, more supply and more demand came to its marketplace. And, today, Amazon sells millions of different items to hundreds of millions of customers around the world, and it is a trillion-dollar company. Marketplaces are powerful things!

Source: https://psmag.com/news/amazon-the-monopolist

Finally, a word about community. Community sounds like one of those things that a business doesn’t care about. All a business cares about is its customers and the cash it takes in, right? Well, a marketplace is no more than a community. And as a company is scaling its marketplace, nothing is more critical than its community.

If the community is not tended to, it will wither away. Every marketplace needs sources of supply and demand, which means that every nascent marketplace needs its sellers and buyers to feel like they’re part of a community. The community is the marketplace and all of OpenSea’s growth opportunities are meant to enhance the community and deliver greater value to the community. OpenSea is starting to engage with its community on Twitter. As I was writing this post, I joined a Twitter Spaces session about CryptoPills:

You can check out the Crypto Pills collection, here. It’s described as “Cryptochemical concoctions, mined from Pillhead’s dissolving metamind. PILLS are collectible crypto-toys scattered across Ethereum. Some PILLS can be bought, some are unlocked, some just appear out of the blue.”

OK, enough about OpenSea’s business model. Let’s look at its growth levers next.

Show Me the Growth!

Let’s be honest. All we care about here is: How does OpenSea grow? Show me the money!

There are a number of growth opportunities for OpenSea: Global Brands, Channel Partners, Inbound and Outbound Pipelines, and Emerging Verticals. Following is a brief discussion of options for each of these growth opportunities.

GLOBAL BRANDS

Think for a minute about Bernard Arnault’s LVMH. He’s worth something like $200 billion: a lot of people like the brands his company sells, and are passionate buyers of them.

Source: https://ceoworld.biz/2021/05/08/luxury-magnate-bernard-arnaults-net-worth-absolutely-skyrocketed-in-2021/

Now these are luxury brands, and maybe luxury brands are not a good fit for NFTs, but there are hundreds of global consumer brands with passionate followings, like Coca-Cola, for which NFT drops may well be very appropriate. This is a great way to get interesting new supply on the marketplace and to acquire new collectors and buyers.

To give you an idea of global brands, here’s one list of “most valuable brands”:

Source: https://www.kantar.com/inspiration/brands/what-are-the-most-valuable-global-brands-in-2021

Of course, these ten companies don’t even scratch the surface of global brands. Coca-Cola did an NFT auction that generated $575,000 in sales:

Auctioned over 72 hours as a single “loot box” via the OpenSea marketplace, the four multi-sensory, friendship-inspired NFTs put a virtual-world spin on iconic Coca-Cola assets. The Friendship Box reimagines a vintage Coca-Cola cooler with dynamic motion and illumination featuring three other NFTs inside: a custom-designed Coca-Cola Bubble Jacket to be worn in the Decentraland 3D virtual reality platform; a Sound Visualizer illustrating the recognizable sonics of enjoying a Coca-Cola; and a Coca-Cola Friendship Card with refreshed artwork from 1948. The winning bidder also will receive an in-real-life, fully stocked Coca-Cola refrigerator.

Now, you may read that and wonder who in the world would spend $575,000 on these items. But there are a lot of people in the world, and some subset of them feel an especially close affiliation with the Coca-Cola brand such that they’re willing to drop six figures on digital goods associated with the company. That’s a pretty powerful testament to a few things: the power of Coca-Cola’s brand, the cultural importance of NFTs, and the prime spot that OpenSea has in mediating this new market for digital culture.

Celebrities, too, see the potential. Here’s New York rapper Busta Rhymes sourcing information about NFTs on Twitter:

Sure, there are a lot of cynical and negative reactions to his tweet. But there is something powerful happening here, which we would be wise not to ignore. A celebrity is crowdsourcing information on Twitter about NFTs. NFTs have quickly diffused into the public consciousness. It is as if people have an instinctive attraction to the notion of a technology which easily allows people to trade cultural goods with one another.

Twitter founder Jack Dorsey sold his first tweet as an NFT for over $2.9 million:

Now, all of this may seem a bit crazy. But consider: there are lots of different brands and lots of celebrities. These initiatives generate buzz, and that helps both the brand or celebrity and OpenSea. Remember: OpenSea’s marketplace is its community, and keeping the community satisfied requires that fresh supply and fresh demand keep coming.

Brands and celebrities are powerful things, evoking deep mimetic desire among people. Consider this insightful piece:

NFTs turn millions of stories into scarce assets

Stories and scarcity are now driving interest in NFTs just like they have for Bitcoin. But the mainstream interest is more intense now for two reasons:

NFTs appeal to people interested in art, music, sports and culture

We’re now seeing new stories attract new people to the cryptocurrency space who don’t care much about money and finance. It turns out there are more people in the world who primarily care about art, music, sports and culture. And stories about art, music, sports and culture tend to be more fun and relatable.

This is brands’ bread and butter: brands spend hundreds of millions of dollars every year to associate their brand with art, music, sports, and culture. Just think of all the Super Bowl ads that companies spend millions on:

How much do you think GM paid Will Ferrell to appear in its Super Bowl ad? Companies intuitively understand mimetic desire, and they are constantly looking for new ways to forge ties with their consumers.

Global brands and NFTs are a perfect fit, and a great growth opportunity for OpenSea.

CHANNEL PARTNERS

Channel partners are companies that market a second company’s product or service. So OpenSea’s channel partners would market OpenSea’s marketplace as a complement to whatever product or service they offer. The idea here is that channel partners can reach customers, on the supply or demand side, that OpenSea would not otherwise have access to. Channel partners increase the width of a company’s customer funnel.

Given this framing, we can think about a few kinds of potential channel partners. Note that I don’t intend any of the examples that follow to be recommendations; they merely provide context for the kinds of complementary services with which OpenSea may strike channel partner relationships. And, obviously, this isn’t an exclusive list; there may be other channel partner categories that I’ve missed.

Metaverse-related environments: this includes digital universes like Decentraland, or blockchain-based games like Axie Infinity (though note that Axie uses its own sidechain, called Ronin).

NFT wallets: examples include Metamask, Enjin, Math Wallet, Trust Wallet, AlphaWallet.

INBOUND AND OUTBOUND PIPELINE

A business is only as good as its pipeline. For OpenSea, there are two pipelines: its inbound pipeline and its outbound pipeline. Let’s take a quick look at each of these:

Inbound. This refers to new supply. New partners, new creators, new brands, etc. that want to issue NFTs on OpenSea.

Outbound. This refers to new demand. New collectors looking to acquire NFTs. New channel partners to market OpenSea’s platform.

Every thriving business needs to manage two pipelines: inbound customer inquiries and outbound sales and business development efforts to acquire new customers. For a company like OpenSea, which does all of its business digitally, there’s a ton of software that can help build out and manage these pipelines. Following is a brief discussion of each pipeline and how it can be effectively managed to grow OpenSea’s business.

Inbound: OpenSea already accepts partnership requests via a public form. I don’t know what its back end system looks like, but one can imagine these data being dumped into a CRM like Hubspot or similar. OpenSea’s internal business development team can then filter and prioritize incoming requests by deal size, prominence of partner, or any other relevant criteria. As OpenSea acquires data on partner performance it can refine its selection criteria and optimize its inbound pipeline.

Outbound: This oerlaps with marketing, a lot, but, basically the way to think about this is in terms of scale. Acquiring customer leads requires a scalable process, such as using Clubhouse or Twitter Spaces to host discussions about OpenSea’s platform, and using OpenSea’s social media feeds (Twitter, Instagram, Discord, Reddit, YouTube, and its newsletter) to market its platform. One trap that OpenSea does not want to get caught in is doing outbound sales on a one-to-one basis. In other words, cold emailing prospective partners one at a time to induce them to partner with OpenSea is non-scalable, and probably not worth its time, given the rate at which it is growing.

EMERGING VERTICALS

Finally, let’s think about emerging verticals in the NFT space. On the one hand, NFTs are so new that it’s not really clear what verticals will arise. I suspect that quite a few will. But let’s focus our attention on one vertical, which has been gaining attention as of late, namely tickets.

Tickets are a great application of NFT technology because each ticket to an event is a unique item, sold to one person, for entry to the event. One company that is trying to develop this market is B.A.M. It claims:

NFT Ticketing is set to completely change the way event ticketing works for good.

Smart NFT Tickets are unique digital assets issued by event organizers, sports clubs and artists. They can be easily transferred or resold, secured by blockchain.

B.A.M. runs its own, presumably centralized, blockchain, so its model is somewhat counter to the more open and decentralized Ethereum-based model that OpenSea operates on.

A software consultancy is trying to sell its services to the NFT ticketing industry. The company notes:

NFTs have the potential to enhance the ticketing experience for both attendees and organizers. Let’s understand how.

Preventing fake tickets and scams. Blockchain provides a single source of truth for both ticket holders and organizers. The transfer of NFTs from the initial sale to resale is stored on the blockchain immutable so that all parties can prove the ticket’s authenticity.

Reduce costs. Costs associated with selling and minting NFTs are negligible as compared to the traditional ticketing system.

Quick production. An NFT can be minted and ready to sell in less than a minute.

Perpetual revenue. Since programmable NFTs can have built-in rules for merchandise, content, resales and royalty splits, it means that the organizer can analyze profit sharing percentages for future resales or creative content on secondary markets and receive funds knowing they are unalterable within the NFTs coding.

Clearly, NFT tickets look a lot different than that conventional tickets that something like Ticketmaster offers. In fact, Ticketmaster’s parent company, Live Nation, is already contemplating a NFT-based ticketing platform:

Before talking about NFTs, Rapino spoke a little less enthusiastically about blockchain for tickets. Often promoted benefits of blockchain for tickets include addressing counterfeits, controlling ticket touts and re-sales and enabling traceability.

Rapino outlines how the move from PDF tickets to digital tickets in a mobile app delivers a key advantage of knowing the details about the customer. So digital tickets without blockchain “unlocked a lot of what you keep reading about the blockchain is going to do in the future,” said Rapino.

Live Nation and Ticketmaster, of course, have a business to protect, and any technology which devolves control away from them is something they’re not comfortable with. This is a story that has repeated itself across all manner of industries: the incumbent got too comfortable, remained skeptical about new technology (for reasons that seem logical at the time), and are disrupted.

It remains to be seen whether NFT ticketing will take off, and, if it does take off, what its effects will be on incumbents like Ticketmaster. But in any event, these emerging verticals will be a vitally important growth opportunity for OpenSea.

I can’t figure out a way to make a Twitter URL appear in Substack (as opposed to an clickable image of the tweet) so this hack will have to suffice. If you want a clickable image to the tweet here you go: