Tesla & the S&P 500; Is Nikola a Latter-day Hindenberg?; Are All SPACs Fraudulent?; A16Z on Covid Vaccine Development

Buy the rumor, sell the news

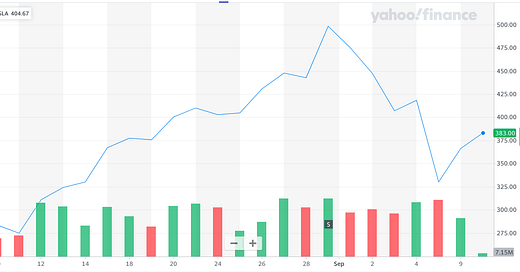

Tesla was not added to the S&P 500 and shares fell on the news. Read on for an explanation.

(Screenshot from Yahoo Finance.)

A common trading strategy is to bet on a particular stock being added to the S&P 500 Index (or other index) by buying the stock and waiting for the news to confirm your intuition. The theory behind this trading strategy is pretty straightforward: when a new stock is added to an index, all the exchange traded funds (ETFs), index funds, and mutual funds that track that index have to buy the stock, which increases demand for the stock.

Given the inviolate relationship between supply and demand, when demand increases and supply remains the same, price increases. So, if you buy, say, Tesla before it is added to the S&P 500, you can ride the stock up as demand for it increases. As we now know, however, Tesla was not added to the S&P 500, and the stock declined from about $420 to around $330.

Tesla bulls, of course, were predictably disappointed in S&P’s snub. Tesla bears snickered, thinking that S&P’s snub proved their case. As with most things, the truth is probably somewhere in the middle:

But size isn’t all that matters to the S&P Index committee. “Unlike the other benchmarks that have already included Tesla in their indexes, inclusion in the S&P indexes isn’t purely rules-driven and systematic; rather inclusion is determined by a committee at S&P’s discretion,” according to Stephanie Hill, head of index, business and strategy at Mellon, part of Bank of New York Mellon (BK). “S&P 500 index selection criteria contains both quantitative and qualitative aspects,” she said in emailed comments.

Tesla qualifies for inclusion based on quantitative metrics. Hill suspects Tesla’s earnings quality—a qualitative factor—might have kept the electric-vehicle behemoth out. Tesla, for instance, earns income by selling regulatory credits. Analysts and investors know about the practice, and it isn’t controversial, but the credit sales aren’t expected to last forever. “[The S&P committee members] want to see no red ink trend from a GAAP perspective to get [Tesla] over the finish line,” Wedbush analyst Dan Ives said.

Of course, none of the information in the block quote above is going to change the bulls’ view on S&P’s refusal to add Tesla to the S&P 500 Index.

The electronic truck company Nikola, named, as with Tesla, after Nikola Tesla, is a target of short-sellers. Is it going to crash and burn?

The Hindenburg crashed and burned in 1937.

The aptly-named equity research firm Hindenburg Research is bettering that Nikola is going to crash and burn. They summarize their research with 24 bullet points at the top of the link; I’ve selected a few that I think are especially interesting, and quote them here:

We examine how Nikola got its early start and show how Trevor misled partners into signing agreements by falsely claiming to have extensive proprietary technology.

In addition to now using GM’s battery technology, Nikola seeks to use the automaker’s production and fuel cell capabilities. Nikola seems to be bringing nothing to the partnership but concept designs, their brand name and up to $700 million they will be paying GM for costs related to production.

Claims of owning energy producing assets is not new for Nikola. Trevor claimed that Nikola’s headquarters has 3.5 megawatts of solar panels on its roof producing energy. Aerial photos of the roof and later media reports show that the supposed panels don’t exist.

Nikola’s much-touted multi-billion dollar order book is filled with fluff. U.S. Xpress reportedly accounts for a third of its reservations, representing ~$3.5 billion in orders. U.S. Xpress had only $1.3 million in cash on hand last quarter.

Nikola’s key partners and backers have been cashing out aggressively. Worthington, Bosch and ValueAct have all sold shares. Worthington sold $237 million shares over a 2-day span in July and another $250 million in August. We think they know exactly what type of company Nikola is, and we expect that as Nikola’s GM “partnership” boosts the stock price, key holders will continue to exit.

As of September 9th, 2020, short positions in Nikola’s stock were around 14.1 million shares. Total daily market volume is about 51.5 million shares. This means that shorts are about 27% of market volume. That seems like a remarkably bearish bet on this stock.

SPACs have a history of fraud. Can better regulation help them?

I’ve written a bunch of posts about SPACs. My most recent post is here, and it discusses Pershing Square’s SPAC offering, and how it differs in structure from earlier SPACs. In my post, I tried to explain why Pershing thinks that its novel SPAC structure better aligns the interests of the SPAC sponsor with the target company and the investing public.

To some extent, the historic underperformance of SPACs, and their associated history of fraud, is a regulatory failure. The law firm Kirkland authored a short report in February 2019 about these regulatory failures:

In the early 2000s, the first generation of SPACs came to market, raising fresh concerns regarding the adequacy of disclosure for companies going public through reverse mergers….While the SEC’s shell company rules should have put to rest concerns that companies merging with SPACs presented a greater risk of disclosure abuses, SPACs found their reputation hard to shake.

The SEC adopted its sweeping “Securities Offering Reform” rules in 2005, the same week it adopted the shell company rules….For example, the SEC allowed certain large issuers with over $1 billion of public float to access the markets without SEC review…However, the rule created a new category—ineligible issuers—considered too risky to be permitted to utilize the new rules.

The SEC included shell companies and blank check companies, which include SPACs, in the “ineligible issuer” category. SPACs are joined in this category by bankrupt companies, penny stock companies, delinquent filers, companies convicted previously of certain felonies and companies subject cease and desist orders for violating the securities laws….An operating company that goes public through a business combination with a SPAC is therefore an “ineligible issuer” for three years….”

VC firm A16Z on COVID Vaccines

A16Z released a podcast recently about covid vaccines. Their description:

WHEN are we going to have a COVID-19 vaccine, and how the heck are we going from (what’s been traditionally been up to) 12 years or so of vaccine development compressed into 12 months or so? What will and won’t be compromised here, and where do new technologies — like mRNA or messenger RNA vaccines — come in? Where will vaccines likely be distributed first, who will and won’t get them initially, both across populations… and nations?

Rajeev Venkayya, president of the Global Vaccine Business Unit at Takeda Pharmaceutical Company and former White House Special Assistant to the President for Biodefense (where, among other things, he was the principal author of the National Strategy for Pandemic Influenza) joins this special deep-dive episode of the a16z Podcast, in conversation with general partner Jorge Conde to discuss all things vaccines. Including where does manufacturing and scale-up come in — is “plug and play” really here? — and by the way, why have we traditionally used eggs in growing vaccines?

Where and how can startups and others participate in vaccine development, given how competitive, time-consuming, capital intensive, and risky it is to develop (and sell) them? Can we decouple the question of how we reopen schools with when we have a vaccine? And how do we maintain not just safety and efficacy of vaccines but trust and transparency when it comes to mis/information? We may actually see the emergence of a “Neo Anti-Vaxxer” thanks to the rush… but we may also be entering a renaissance for vaccinology after this pandemic. So what changes, what doesn’t?