Snowflake vs CoreWeave: Two Infrastructure Companies. One Moat

CoreWeave has no moat; Snowflake has a deep one. What can CoreWeave learn from Snowflake?

This post complements my earlier post about CoreWeave’s business model.

Introduction: CoreWeave is executing brilliantly but could still learn from Snowflake

Ours is the age of AI hype, and in this age, few names are hotter than CoreWeave. After pivoting from crypto mining to GPU cloud services, the company has landed multibillion-dollar contracts, grown revenue nearly tenfold in under two years, and just IPO’d at a $26 billion valuation.

The pitch is clear: AI demand is surging. Nvidia GPUs are scarce. CoreWeave offers dedicated access to premium chips for inference and training workloads. Simple, fast, and seemingly inevitable.

But under the surface, CoreWeave is executing a high-speed arbitrage on temporary scarcity, not building enduring infrastructure. It doesn’t own the land beneath its data centers. It doesn’t control its supply of GPUs. It doesn’t operate a proprietary software layer that binds customers to its ecosystem. Its moat is shallow. Its dependencies are deep.

To understand why this matters, and what long-term defensibility in infrastructure actually looks like, it’s worth contrasting CoreWeave with Snowflake.

Snowflake owns no chips. It owns no data centers. Yet it’s worth $60+ billion and has one of the highest net dollar retention rates in SaaS. It didn’t win by controlling hardware. It won by building platform gravity.

The comparison isn’t perfect. But it’s clarifying. Here’s what CoreWeave could learn from Snowflake, and why it probably won’t.

Infrastructure Isn’t Enough

CoreWeave and Snowflake are both infrastructure companies in the broad sense. Both offer behind-the-scenes, mission-critical capabilities to other businesses. But their strategies and positions in the stack could not be more different.

CoreWeave leases data center space from landlords like Digital Realty and Chirisa. It buys Nvidia H100 and A100 GPUs, reportedly at favorable terms during times of scarcity, and spins up high-density clusters for AI startups and enterprises. Customers include OpenAI, Microsoft, and Stability AI. In 2024, CoreWeave reported $1.92 billion in revenue, but it also posted a net loss of $863 million. The company also has an $11.9 billion multi-year contract with Microsoft, which reportedly accounts for over 60% of its top line. Lease obligations for its data center footprints are long-term and non-cancellable, locking CoreWeaves into a high fixed-cost structure with no asset appreciation. This capital intensity and supplier dependency create a narrow margin for strategic error. The business is capital-intensive, thin-margin, and hyper-reliant on a few big names.

Snowflake, by contrast, doesn’t own physical infrastructure. It runs on top of AWS, Azure, and GCP. Its core product is a cloud-native data platform. It is essentially a SQL engine designed for elastic, pay-as-you-go workloads across multiple clouds. Customers query structured and semi-structured data, paying only for what they use.

The result? In FY2024, Snowflake generated $2.8 billion in product revenue with a 76% gross margin. It ended the year with over 400 customers doing more than $1 million in trailing 12-month product revenue and a 131% net revenue retention rate.

Snowflake’s success has not been without friction. It remains highly dependent on hyperscalers to deliver its services, and its margins, while strong, are bounded by infrastructure pass-through costs. Its growth has slowed from triple-digit to double-digit rates, and competition is increasing from DataBricks, Google BigQuery, and vertical SaaS players integrating lightweight analytics.

Still, Snowflake has established itself as a layer of abstraction insulated from infra volatility. But it’s not immune: its gross margins are ultimately capped by hyperscaler pass-through costs, and its growth faces pressure from adjacent platforms like DataBricks, Google BigQuery, and emerging vector-native databases. Nonetheless, Snowflake retains strategic leverage through its developer ecosystem, its proprietary control plane, and the entrenchment of data gravity.

What Does Defensibility Look Like?

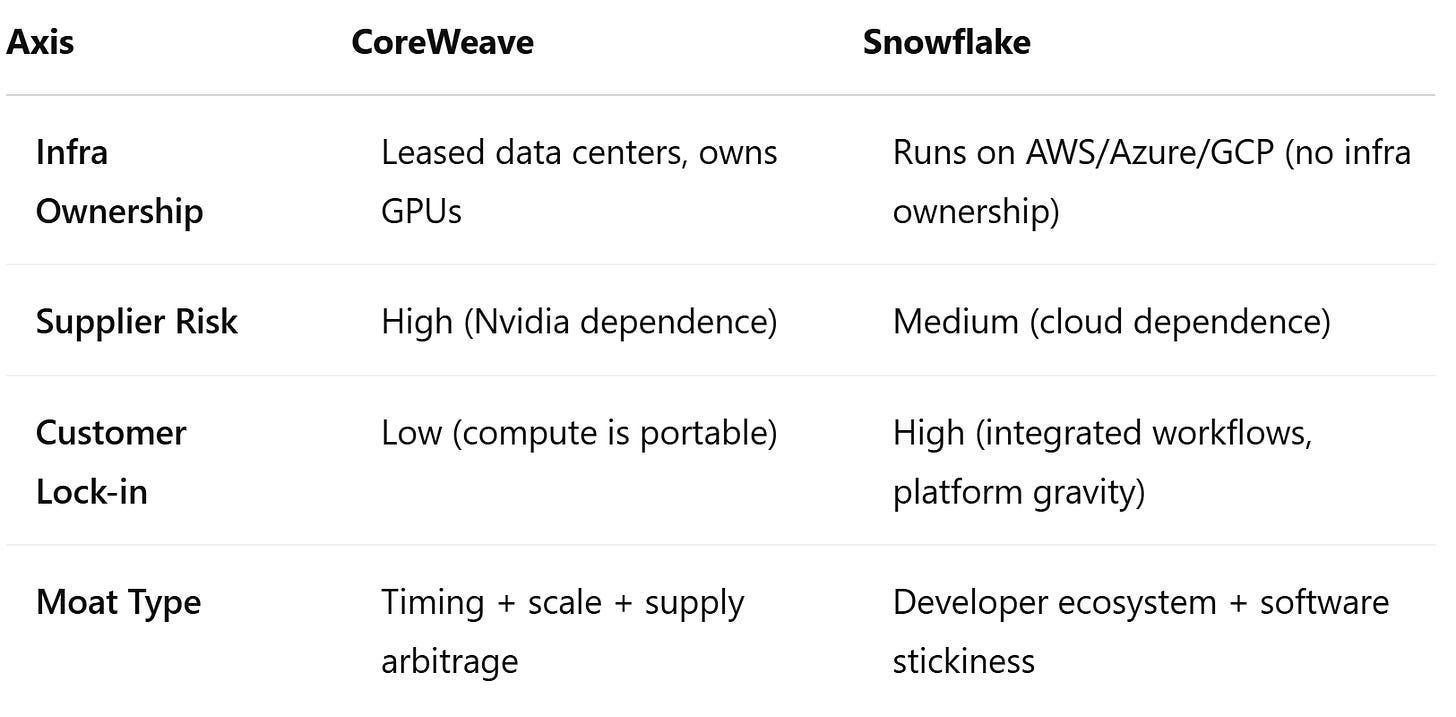

Let’s break this down across four key vectors:

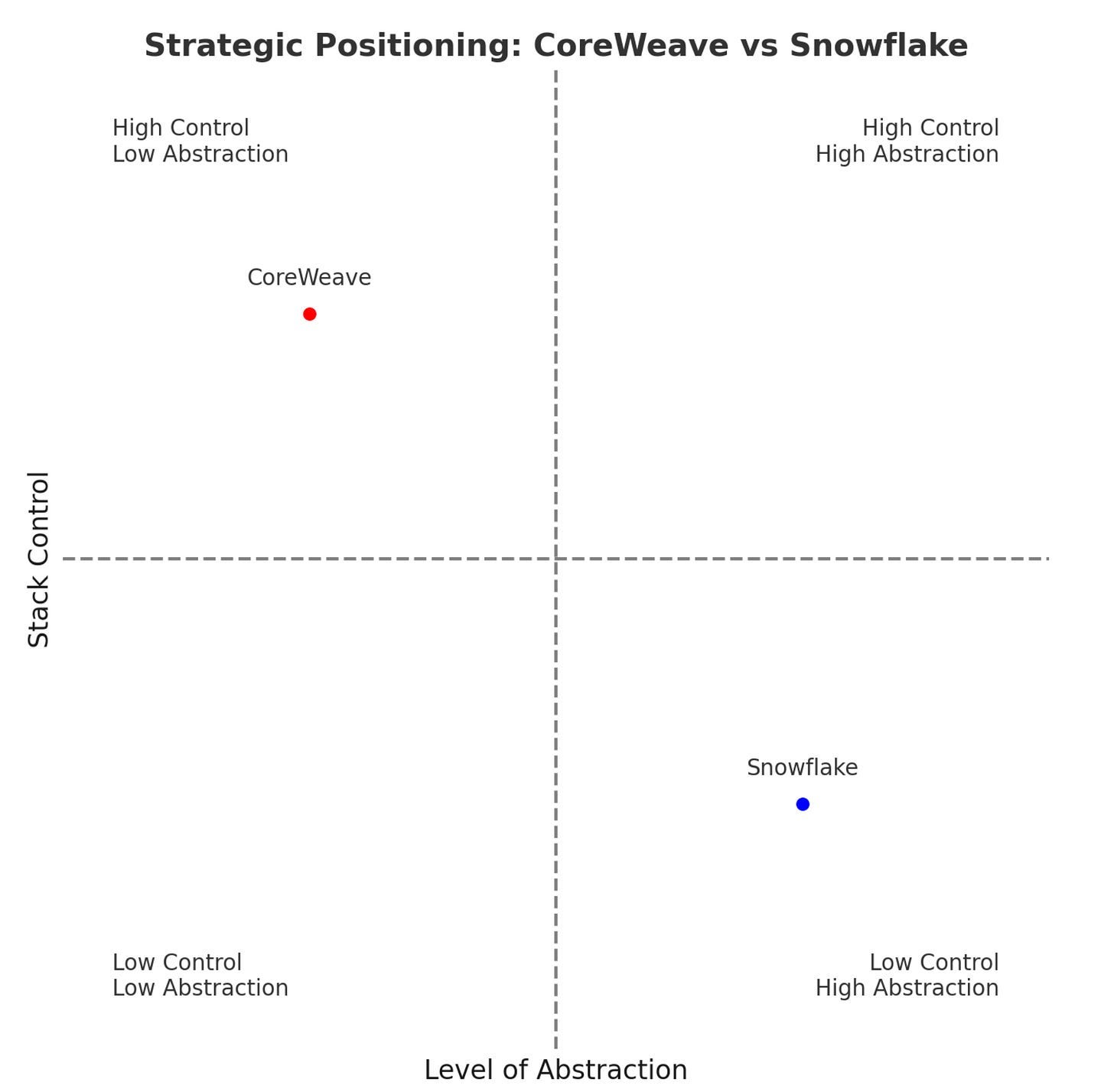

To visualize their respective strategies, consider a 2x2 matrix comparing stack control (y-axis) and level of abstraction (x-axis)

This matrix reveals a deep asymmetry in how these companies capture and defend value:

CoreWeave is in the upper-left: high control over infrastructure (GPUs, clusters, deployment speed), but low abstraction. It sells raw compute with minimal product stickiness.

Snowflake is in the bottom-right: high abstraction (SQL engine, orchestration, usage-based pricing) and low stack control (runs entirely on public cloud).

Strategic Insights from the Matrix:

Power comes from abstraction, not ownership. Snowflake doesn’t own the hardware, but it owns the interface. It monetizes workflows, not machines. CoreWeave owns chips, but not the control layer.

Control without abstraction is fragile. CoreWeave’s logistics edge is real, but if pricing collapses or Nvidia favors other customers, it has no cushion. Snowflake, meanwhile, retains customers even when cheaper tools exist, because switching is costly.

Abstraction becomes more defensible over time. Snowflake’s value compounds as more data, models, and internal tools are built on its platform. CoreWeave’s value decays as GPU scarcity fades.

Where you start determines what you can become. Snowflake began with platform-first DNA. CoreWeave began as a hardware provisioning business. Reinventing yourself mid-flight into a product-first company, while racing against hyperscalers, is brutally difficult.

This matrix isn’t just a snapshot of strategic posture. It’s a map of strategic optionality. Snowflake has it. CoreWeave has to earn it.

CoreWeave sits in the top-left: high control (it owns GPUs, negotiates directly with landlords), but low abstraction (it offers raw compute).

Snowflake sits in the bottom-right: high abstraction (a full software platform), but low control (it runs entirely on other people’s infrastructure).

This difference explains their strategic posture: CoreWeave monetizes supply-side scarcity; Snowflake monetizes user-side entrenchment.

Snowflake’s data-sharing capabilities, support for modern data architectures, and partner ecosystem create multi-dimensional lock-in. The more you build around Snowflake, the harder it is to leave.

CoreWeave has no such gravity. It is a throughput business, not a context-aware one. It sells access, not abstraction. Customers don’t “live” on CoreWeave the way they live on Snowflake.

If You Build It, They Might Leave

What happens when scarcity fades?

The AI chip supply chain is still tight, but that won’t last forever. TSMC is scaling H100 and H200 production. Nvidia is increasing allocation to hyperscalers. AMD’s MI300X is entering deployment. Meanwhile, sovereign compute initiatives (UAE, India, Saudi Arabia) are building their own clusters.

When supply normalizes, hyperscalers will slash prices, bundle GPUs into attractive PaaS offerings, and flood the zone with developer tools. Startups that once paid a premium for CoreWeave’s clusters will migrate to AWS or Azure—especially if the software environment is better integrated.

And the software environment will matter. Today, CoreWeave offers containerized environments with orchestration features. But it lacks a true control plane. There’s no proprietary SDK. No Snowflake-like abstraction that makes customers stay even when costs go up or competitors undercut.

Platform Gravity vs Infra Velocity

The root difference between CoreWeave and Snowflake is not just about the business model. It’s about time horizons and control surfaces.

Snowflake is built for long-term embeddedness. Its pricing model aligns with customer growth. Its integrations deepen with usage. Its moat compounds with data gravity.

CoreWeave is built for opportunistic capture. Its pricing model is arbitrage. Its key advantage—GPU access—is fragile. Its largest customer (OpenAI) is itself backed by Microsoft, which could easily pull workloads back in-house.

Snowflake wins by becoming the substrate of modern data workloads. CoreWeave wins by staying slightly ahead of hardware constraints. One compounds. The other hustles.

Could CoreWeave Build a Snowflake-Style Moat?

In theory, yes. It could:

Build a proprietary orchestration layer optimized for LLM training

Launch an SDK for AI model deployment

Offer native MLOps pipelines and fine-tuning tools

Build multi-tenant data-sharing within clusters (a GPU-native “Snowgrid”)

But this would be a second act, and a hard one.

It requires new talent and culture (developer-first, product-oriented)

It means competing not just with GPU clouds, but with Hugging Face, Replicate, Modal, and the hyperscalers

It requires patience—something CoreWeave may not have if margins compress post-scarcity

Snowflake spent a decade building its moat. CoreWeave may only have 12–24 months before hyperscalers undercut it and landlords squeeze it.

The bigger issue may not be what CoreWeave must build, but whether it's culturally and operationally capable of building it.

Snowflake’s founding team had deep roots in enterprise software and analytics. It grew methodically. Its leadership understood the developer mindset, designed for usability, and optimized for long-term data entrenchment. Its entire company culture is product-first.

CoreWeave, by contrast, is execution-maximalist. It was founded by ex-crypto miners, pivoted into AI at the right moment, and proved itself exceptional at operational hustle—securing GPUs, building clusters fast, and deploying capital efficiently. But speed and logistics do not translate directly into product depth or developer love.

That’s the crucial divergence: Snowflake was a software product company from day one. CoreWeave is an infra deployment shop trying to learn software gravity under duress.

The Bull Case—and its Demands

Let’s be fair: the bull case isn’t wrong. CoreWeave could evolve. It has cash from the IPO. It has name recognition. It has GPU supply. Nvidia seems to favor it, at least for now. It could use its early-mover momentum to build something deeper.

But the bull case is demanding.

It requires:

Building a sticky software layer while managing hardware scale

Securing GPU supply from a single supplier with massive power

Avoiding margin death via hyperscaler commoditization

Outrunning commercial real estate landlords

Shifting organizational DNA from execution to product

It’s a race against gravity—with no parachute.

Snowflake never had to run this fast. It built carefully, abstracted away its suppliers, and created value above the infra layer. It didn’t need to own chips—it just needed to own the query path.

CoreWeave owns chips, leases land, and doesn’t own anything up the stack. That’s the difference.

Who Takes CoreWeave’s Place if it Fumbles?

If CoreWeave cannot evolve into a platform business, it leaves an opening for others to claim the middle layer between hyperscalers and AI-native teams. Likely contenders include:

Lambda Labs – Bootstrapped for years, with strong GPU cloud + on-prem offerings and deep technical DNA.

Voltage Park – Backed by billionaire Jed McCaleb, it operates as a nonprofit GPU provider with over 24,000 H100s.

Sovereign compute initiatives – Nations like the UAE and India are building their own GPU infrastructure—sometimes with Nvidia’s blessing.

In each case, the risk to CoreWeave is the same: if it doesn’t move up the stack quickly enough, someone else will commoditize what it currently monetizes.

Strategic Takeaways

For founders, operators, and investors, here’s what this comparison reveals:

Abstraction > Access – Ownership of GPUs is less defensible than ownership of workflows and interfaces.

Logistics doesn’t scale moats – Speed and capex efficiency are necessary, but not sufficient, for long-term defensibility.

Culture compounds – Snowflake’s developer-first, product-oriented culture gave it the patience and architecture to entrench. CoreWeave must pivot its DNA.

Second acts are rare – Reinventing a company’s strategic layer mid-flight—especially with hyperscalers watching—is extraordinarily difficult.

Scarcity isn’t strategy – It’s a window. You either build your moat while it’s open, or fall when it closes.

Conclusion: Renters vs Architects

CoreWeave is a powerful company riding a powerful wave. But its position is ultimately intermediary—not foundational. It lives downstream of Nvidia. It lives upstream of better-integrated software stacks. It lives on leased land.

Snowflake, by contrast, operates one level up. It is an architect, not a renter. Its advantage isn’t timing or hardware—it’s entrenchment. It doesn’t just offer compute. It offers control.

CoreWeave has mastered operational velocity. But to endure, it must build product gravity. Whether it has the executional and cultural range to pull that off remains uncertain.

Two infrastructure companies. Only one moat.

Thanks for reading. If you found this useful, subscribe for more deep dives on tech infrastructure, AI supply chains, and strategic edge in a post-scarcity world.